Technology is transforming every professional and the insurance industry is n...

The insurance industry can be a complex and multi-layered maze where numerous companies offer similar financial security promises and competitive rates. In the crowded space of this 5.5 trillion U.S. dollar business, what truly sets an insurance organization apart is its customer experience. Can customers easily navigate through the details of insurance products and services? Conversational AI in insurance transforms the customer experience by providing real-time and personalized support.

This article will explore the details of the role of conversational AI in insurance and how it is helping to constantly improve the customer experience.

Insurance can be defined as a contract or policy that provides financial protection in case an accident or unpleasant event occurs to the policyholder or insured person. It is a dynamic system of companies that plays a vital role in providing financial security to individuals and businesses.

The insurance industry is all about managing risk. It usually works through a set of contracts between the insurance company (insurer) and the individual (policyholder). The policyholder pays a regular fee (premium) to the insurance company. The insurance company pools the premium by other policyholders to cover potential claims. If something unexpected (like an accident) happens to the policyholder, they file a claim, and the insurance company pays them back a certain amount according to their policy.

There are many different types of insurance available, including:

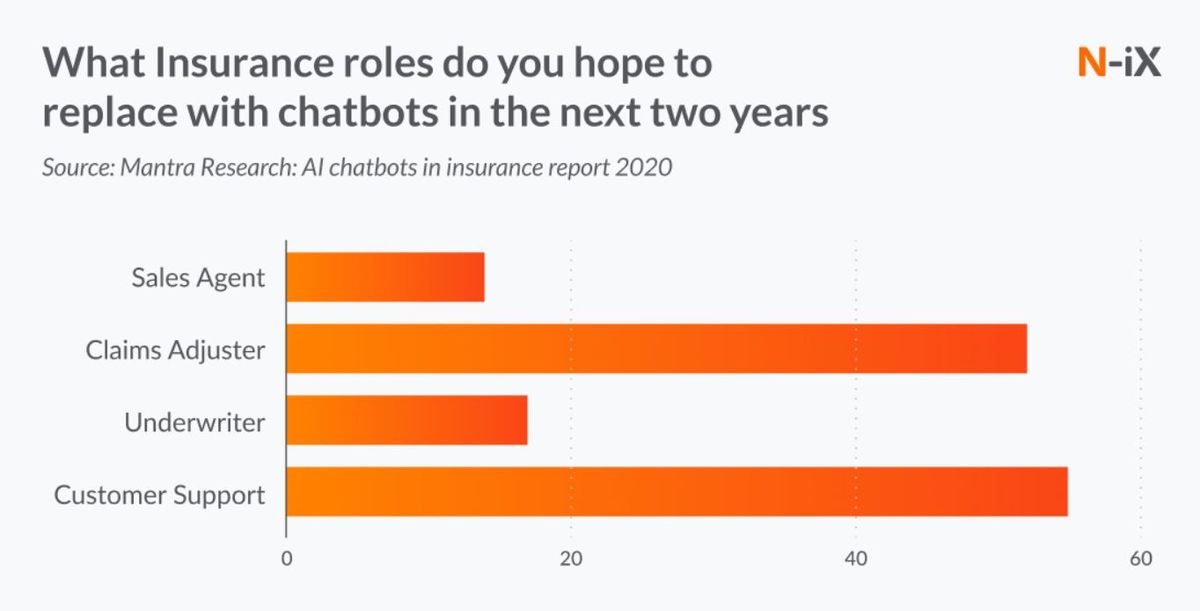

The traditional insurance industry relies on three key players, i.e., the insurance company offering protection, agents who guide clients to the right policies, and the clients themselves seeing financial security. Every step, from initial contact (onboarding) to ongoing service and claim processing, involves constant interaction and customer support.

Conversational AI is software applications that are designed for engaging and human-like conversations with users through text or voice format. Conversational AI in insurance is transforming how insurance companies conduct their business or interact with customers. Here is how:

Conversational AI acts as a visual assistant in the insurance industry that can streamline tasks like customer education, policy renewals, and payments while simultaneously providing 24/7 customer support, boosting efficiency and customer experience. Let's look at some of the key use cases of conversational AI in insurance.

Customer education and support are the most prominent uses of conversational AI in insurance industry. Insurance policies could be tricky and complex for a normal or non-professional person. This can leave customers confused and unsure about what they truly need. Here is how conversational AI for insurance can bridge this gap and act as a virtual customer educator:

Keeping your insurance coverage alive relies on timely payments. Conversational AI chatbots can help you explain different premium options, answer questions about billing cycles, and even guide you through the online payment process. This 24/7 availability ensures you never miss a payment and keeps your insurance running smoothly.

Underwriting can be a slow and time-consuming process, but conversational AI can accelerate it by analyzing customer data from chatbot interactions. This allows insurers to create a more nuanced risk profile and offer customized plans. For example, a chatbot asks about your home security system and driving habits; these insights, combined with traditional data, help companies make informed decisions and offer you more competitive premiums.

Conversational AI can be a great tool for automating and streamlining the claim management process. A chatbot can walk you through the claim process step-by-step. It can ask clear questions to understand the situation, gather necessary details, and even handle pre-claim assessments.

Based on its analysis, the chatbot can help you file the claim electronically and skip the lengthy paperwork. This eliminates all confusion, allowing you to focus on what matters the most, i.e., getting back on your feet after a loss.

Statistics show that 10% and 20% of insurance claims are fraudulent. Conversational AI can act as a guardian against fraud. They can track every customer interaction and keep track of every detail the customer provides. This allows them to track inconsistencies that might raise a red flag. These red flags or danger warnings can be further investigated, potentially saving the insurance company from fraudulent claims and scams.

The above use cases are just a glimpse of conversational AI's potential in insurance. Dedicated chatbots for insurance agencies can provide you with a wide range of benefits, such as increasing operational efficiency, customer retention, and personalizing the customer journey.

Conversational AI is transforming insurance by providing many benefits, such as 24/7 customer support, personalized customer experiences, and empowering informed decisions. Let's take a look at them.

According to PWC, 86% of insurance companies responded that they can create better customer service experiences using the power of AI. This is because it provides a personalized customer experience by offering proactive 24/7 support. AI chatbots are always available, especially when immediate action is needed, like filing a health, life, or home insurance claim. This anytime, anywhere availability ensures customers can get the support they need exactly when needed.

Conversational AI is a great source for improving operational efficiency and reducing costs for an insurance organization. These virtual assistants are capable of handling a massive influx of customer queries and routine tasks at any given time.

Imagine a scenario where a surge in policy renewal inquiries hits your customer support. AI chatbots can efficiently address these inquiries without needing extra staff. Here is how conversational AI boosts cost efficiency:

According to McKinsey, AI investments can drive up to $ 1.1 trillion in potential annual value for the insurance industry.

Conversational AI ensures a consistent and accurate customer experience for every customer interaction. These chatbots act as an extension of an insurance company's knowledge base, seamlessly integrated with customer data and resources like FAQs, guides, and articles. This allows them to provide immediate answers to a wide range of queries, regardless of the time or day.

Conversational AI chatbots are a valuable data collection tool for insurance businesses. These chatbots keep track of every customer interaction, from basic information from names and contact details to specific policy details discussed during conversations. By analyzing these interactions, insurance companies can understand customer sentiment, Identify recurring issues and pain points, and evaluate how well their current policies perform.

Here are examples of some of the best insurance chatbots that are transforming the future of insurance and providing highly personalized experiences.

Qatar Insurance Company (QIC), a major stakeholder in the Middle East, is leading the way with Anound, its AI chatbot. Integrated into their website and mobile app for the past two years, Abound empowers customers with a self-service experience.

It eliminates the need for constant human interaction by answering customer queries to facilitate policy renewals and claims. This innovative policy has led to impressive results: QIC reports a 2% rise in premiums within a year of deployment, alongside multiple industry awards.

Nienke is Nationale-Nederlanden's (Dutch insurance company) virtual assistant. It is designed to simplify the insurance process and make it a smooth customer journey. Whether customers have questions about deductibles or need help navigating claim procedures, Nienke is available 24/7 as an insurance assistant to answer FAQs and guide customers regarding insurance policies.

Lemonade is a famous American insurance company that offers life, car, pet, and home insurance. They have been using 'Jim,' the AI assistant, for the past few years. Jim is an intelligent AI chatbot that is designed to handle all aspects of the insurance experience but truly excels at speeding up the claim process.

Lemonade holds the world record for the fastest AI claim settlement, achieved by Jim in a record-breaking 2 seconds. When a customer needs to file a claim, Jim can guide them through the process quickly and efficiently, saving time and stress.

Conversational AI chatbots act as virtual assistants for insurance companies, simplifying the onboarding process, offering 24/7 customer support, and guiding customers through claim filing. Implementing AI support and AI chatbot customer service can significantly benefit insurance businesses.

It can provide consistent and informative customer support, automate routine tasks, and gather valuable customer data. By leveraging conversational AI, insurance companies can stay connected with their customers, understand their needs, and deliver exceptional customer experiences.

Do you want an AI powered ecosystem for your insurance business? Switch to Aidbase to give your users an outstanding customer experience.