Do you want one time buyers to become regular customers? Discover the power o...

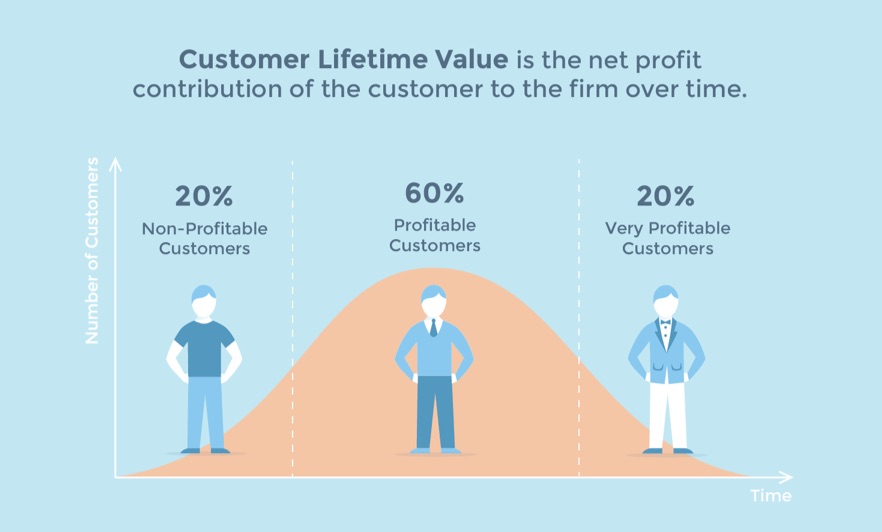

Businesses rely on various metrics to track their health, but none offer a more comprehensive view than Customer Lifetime Value (CLV). Unlike other metrics that focus on isolated moments, CLV offers a holistic view, considering past revenue, current customer engagement, and future earning potential.

According to a study conducted on CLV, 89% of business owners admitted that CLV has helped them gain more sales, and 68% saw an increase in customer retention. It is a financial compass that guides your business toward growth and a loyal customer base.

This article will explore customer lifetime value and its importance and equip you with practical strategies to boost your CLV organically.

Customer Lifetime Value (CLV) is a valuable metric used in retail and e-commerce businesses. It helps estimate the total amount of revenue a single customer will generate throughout their entire relationship with your brand. It goes beyond a single purchase, considering a customer's entire purchase history and predicting their potential future spending with your brand. Think of it as a way to measure what a customer brings to the table in terms of monetary benefit.

Calculating CLV is simple; here is the standard customer lifetime value formula: Customer Lifetime Value (CLV) = Customer Value x Average Customer Lifespan. Let's understand it with the help of an example:

Imagine you are a business owner offering a cloud-based customer service automation platform for a $150 monthly subscription. The average CLV of a customer who stays with you for two years would be:

Customer Value (CV):

Therefore, Customer Value (CV) = $150/month * 24 months = $3600

Customer Lifetime Value (CLV):

Now that we have the Customer Value, we can find the CLV using the formula:

CLV = Customer Value (CV) x Average Customer Lifespan

CLV = $3600 (CV) * 2 years (Average Customer Lifespan) = $7200

So, the average CLV of a customer who stays with your platform for two years at the $150 monthly subscription would be $7200. But this is just the beginning.

Customer lifetime value can grow significantly because happy customers do more than just stay subscribed. They might:

Strong CLV, as shown here, goes hand-in-hand with happy customers. Satisfied subscribers tend to stick around longer (lifespan) and potentially invest more (value). This highlights a strong link between customer satisfaction and CLV.

While calculating customer lifetime value, there are two perspectives to consider: historical customer lifetime value and predictive customer lifetime value.

As shown by name, historic CV is determined by looking at past relationships and transactions. It considers a customer's entire purchase history with your business to estimate their total contribution.This historical view is valuable for understanding which customer segments are most profitable and identifying opportunities for future engagement.

Predictive CLV goes beyond past purchases. It's a systematic process that analyzes historical CLV data and makes smart predictions about customer future value. This involves evaluating various customer segments, preferences, and engagement patterns to predict their potential worth for your business.

Let's suppose you run a company that sells fitness trackers. Looking at historical CLV data (past purchases), you observe that Steven, a regular gym-goer who uses all your app features, spends $100 a year on subscriptions and accessories. This high historical CLV suggests Steven is a valuable customer.

Predictive CLV goes one step further. By analyzing Steven's data (purchase behavior, engagement), you can predict his future actions. This analysis might suggest he'll upgrade to a premium tracker next year. Furthermore, his high engagement indicates he might be interested in buying new workout apparel from your store. This future value makes him a priority customer for your business, and he will bring additional revenue to your brand.

Customer lifetime value is more than just a number. It's a forward-looking approach that considers the critical elements of business growth. By understanding CLV, you can predict future sales and prioritize initiatives that improve customer experience. In essence, CLV provides a holistic view that empowers you to make decisions that enhance growth, sales, profits, and customer happiness.

According to Gartner, 25 percent of marketers rank CLV among their top 5 metrics. Here is why:

Acquiring new customers is an expensive process, often 5 to 7 times more expensive than retaining existing ones. Marketing campaigns across various channels require significant resources, and their success can be unpredictable. The bright side? Existing customers are much more likely to repurchase (60-70% chance) compared to new ones (5-20%).

This is where Customer Lifetime Value (CLV) becomes crucial. By focusing on CLV, you prioritize high-value existing customers with a higher conversion rate. This focus on retention, fueled by CLV insights, leads to a more sustainable business model that thrives on loyal customers.

CLV pinpoints high-value customers**.** By analyzing past purchases, you can identify those likely to spend more (think $100 vs $10). This lets you target similar high-quality leads during acquisition. With a focus on these potential big spenders, you can streamline your budget and increase conversion rates. This targeted approach makes your acquisition efforts more efficient.

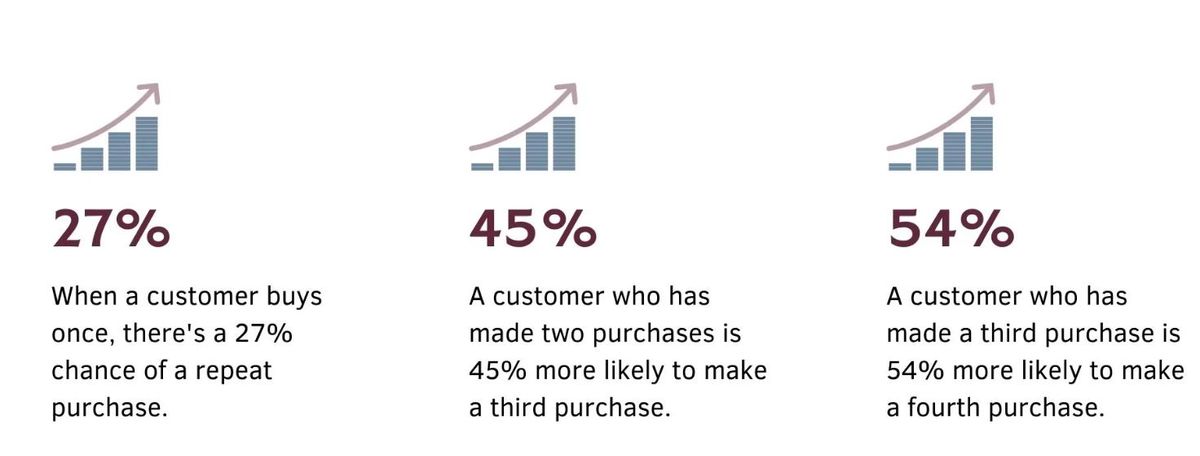

A steady stream of income keeps your business running smoothly. It helps cover costs, pay bills, and plan for the future. Stats show that there are 27% chances of a repeat purchase from a first-time customer, 45% from a second-time customer and 54% from a third-time customer.

Customer lifetime value helps you identify customers likely to become repeat buyers and reduce your reliance on constant new customer acquisition. This loyal customer base creates a predictable income flow that helps you to focus on growth and innovation.

Source: GetUplift

Customer lifetime value helps you generate recurring revenue and profit. You can reinvest these resources in strategic growth initiatives, like expanding to new markets, pursuing R&D, or enhancing your marketing reach.

Customer lifetime value analysis is a subtle way of evaluating your performance. High CLV indicates happy customers who keep coming back, likely due to your great products or service. On the other hand, a low CLV might point to underlying issues such as poor customer experience or irrelevant marketing.

Low CLV could be an early sign of customer churn. To tackle this, proactively engage with your customers. Use CLV data to identify areas for improvement (support, onboarding, marketing) and address their concerns. By analyzing CLV and making genuine efforts, you can move low-value customers towards the mid-tier and high-value segments.

Now that you know the power of Customer lifetime value in marketing, revenue, and retention. Let's explore how to build genuine customer relationships, win their trust, and deliver exceptional experiences through different techniques. This will boost your CLV and drive sustainable business growth.

A smooth onboarding process sets the tone for your entire customer relationship. Design it as a guided journey that shows your customer how your product can solve their problems and deliver maximum value.

According to a survey, more than 55% of customers return a product because they never fully understand how to use it. Just as seamless onboarding increases customer loyalty, a confusing one often leads to churn.

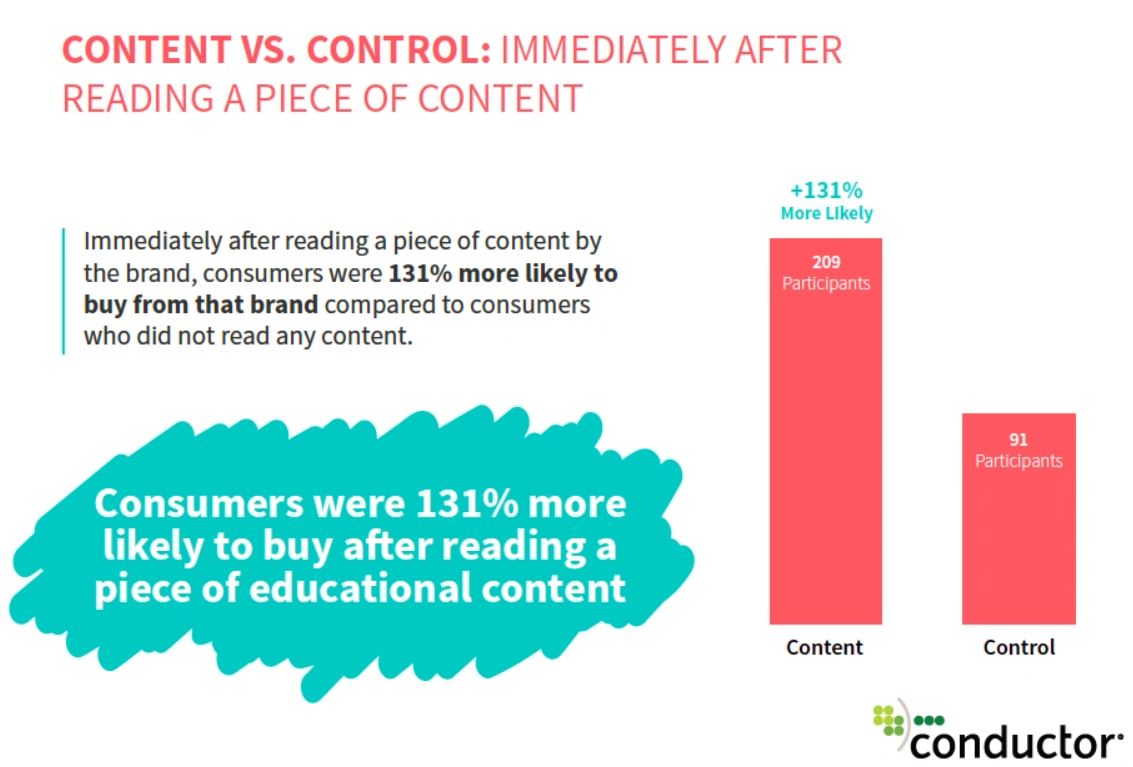

Don’t let your website be a dead end when you can convert visitors into customers with the help of content marketing. According to a survey by Conductor, customers are 131% more likely to buy from a brand immediately that offers educational content.

That’s a massive figure, right? Because value-driven content is customer education in disguise. It teaches customers how to utilize your product's full potential and integrate it seamlessly into their workflow. This empowers them to maximize its benefits and achieve their desired outcomes. Here are different formats to engage your audience:

Source: Conductor

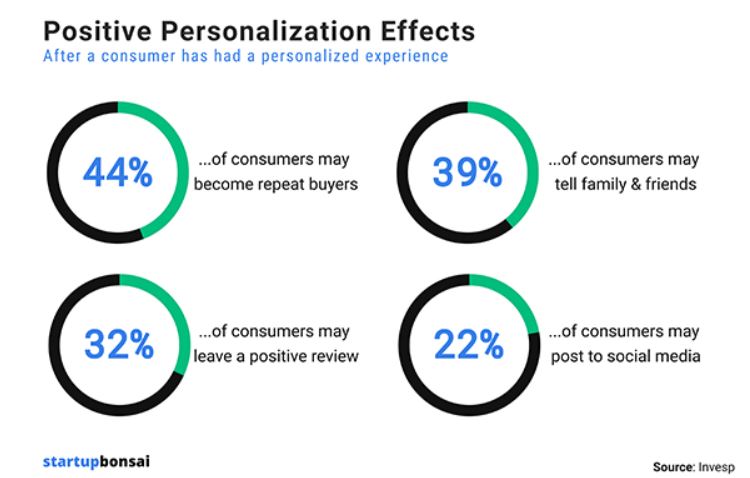

Customer lifetime value thrives on value creation for your customers. One-size-fits-all marketing simply doesn't resonate with customers anymore. In fact, Forbes reports that 81% of customers expect a personalized experience from brands. Technology like AI chatbots and customer data analysis can help you achieve that.

These applications use customer data (names, preferences, purchase history) for targeted communication that builds relationships beyond sales. Here's how to Increase the lifetime value of a customer by moving beyond transactions:

Source: Startup Bonsai

Customer service excellence is critical to maximize customer lifetime value (CLV). The level of support a business offers significantly impacts customer loyalty. An independent research by New Voice Media reveals that 40% of customers leave a business because they feel undervalued or unappreciated by businesses.

Empower your Customer Service Representatives (CSRs) to become product or service experts, trained to handle everything from basic details to troubleshooting.

However, maintaining exceptional service can be a demanding task. This is where AI can become a valuable asset. Implement AI chatbots alongside live chat support for a two-pronged approach. Chatbots can handle routine inquiries, answer questions about order tracking, and provide basic assistance. Meanwhile, live chat enables your CSRs to focus on complex customer needs, develop personalized solutions, and nurture customer satisfaction.

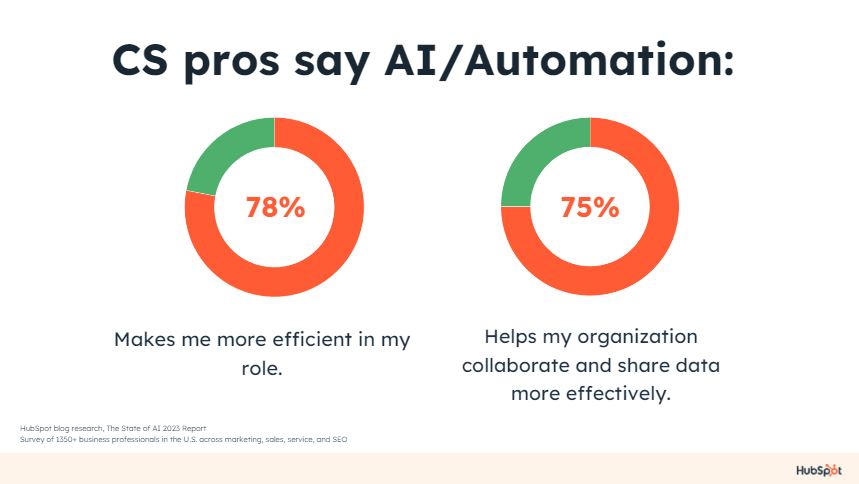

Source: Hubspot

While high-CLV customers deserve attention, low-CLV customers offer valuable insights. Their experiences can reveal early signs of churn. This helps you to intervene and improve customer retention. Here's How to Collect Customer Feedback:

Collecting customer feedback enables you to identify areas for improvement and adapt your approach to create a more satisfying customer experience.

A positive customer experience is the key to both customer retention and high Customer lifetime value. It is the sum of all interactions and emotions a customer experiences with your business. A consistently low CLV can signal a poor customer experience.

To optimize CX, look at customer data across various touchpoints (website, live chat, support interactions, return policies). Analyzing customer behavior patterns through this data can reveal problem areas.

Examples: Is your website interface confusing, leading to abandoned carts? Are your live chat responses slow or unhelpful? Is the return policy unclear, generating frustration?

By pinpointing these issues, you can optimize your CX. Improve website interface, enhance chat responsiveness, and clarify return policies. Statistics show that 61% of millennials are willing to pay more for a superior customer experience. Investing in CX upgrades leads to happy customers with high customer lifetime value.

For SaaS and cloud-based businesses, a strategic pricing structure can impact customer lifetime value (CLV). Consider offering flexible billing options, like monthly and annual plans, to accommodate varying customer preferences.

There are typically two customer types: those who need your service for a short period (2-4 months) and long-term subscribers. Incent the latter with a discount of 15-20% on annual plans. This discount might seem like a loss upfront, but you can use the extra revenue in research and product development.

An additional advantage of annual billing is improved revenue predictability. Locking in customers for a year gives you a clear picture of future income and allows better financial planning and resource allocation.

Upselling and cross-selling work together to boost customer lifetime value (CLV). Upselling involves offering customers a higher-tier version of your product, like moving from a "Basic" to an "Advanced" plan in a SaaS model. This provides more features, increases their investment, and increases the chances of a higher CLV.

Cross-selling, on the other hand, focuses on recommending additional products or services along with their existing purchase. Imagine an e-commerce business suggesting phone cases alongside a new phone. Both strategies aim to expand customer spending and strengthen their relationship with your brand.

McKinsey states that cross-selling and targeted marketing can increase sales by 20 and profits by 30%. Here is how:

No two customers are alike in their preferences and purchasing habits. To provide an exceptional experience for everyone, consider making your business processes more flexible and accommodating.

Building customer lifetime value goes beyond just making a sale. Here's how to turn customers into loyal advocates:

Customer lifetime value is not just a KPI or metric but a roadmap to sustainable business growth. By prioritizing customer experience, implementing strategic tactics, and building long-lasting relationships, you can turn one-time buyers into loyal advocates.

Customers with high CLV will supercharge your business growth by generating more revenue for your business over time through repeat purchases. Utilizing this potential requires a deep understanding of customer behavior and preferences.Here's where AI Support stands out.

An AI-powered customer service can gather invaluable data beyond basic demographics. The use of AI chatbot customer service helps you analyze customer interactions, identify buying patterns, and even detect sentiments. With these rich insights, you can provide a personalized customer experience and increase your customer lifetime value.

Here are some examples of how CLV can be applied in different businesses:

There's no fixed timeframe for calculating CLV. It depends on the average lifespan of a customer in your industry. For example, a subscription service might estimate a CLV based on a 2-3 year timeframe, while a car manufacturer might consider a 10-15 year timeframe.

Here are some factors to consider when choosing a timeframe for CLV:

Customer value (CV) is the worth of a single purchase, while customer lifetime value (CLV) estimates a customer's total revenue over their entire relationship with your business. Think of CV as the cost of a single cup of coffee you sell and CLV as the total amount a customer spends at your coffee shop over the years.